The UAE boasts the world’s largest tax treaty network, with 90 double taxation agreements currently enforced. Moreover, the country remains dedicated to expanding its roster of tax treaties with additional nations. This positions the UAE as one of the most attractive destinations for businesses and individuals seeking to mitigate the risk of double taxation.

Membership in the GCC proves highly advantageous for the UAE, affording access to a robust economic network that aids in the country’s pursuit of income diversification goals. Facilitating the exchange of goods and services among member states, GCC membership also simplifies the resolution of tax-related issues.

UAE-based businesses can now leverage the benefits of double tax treaties between the UAE and other nations. These agreements safeguard residents and companies from being taxed twice on the same type of income while providing clear guidance on tax obligations for various income streams.

The UAE has established numerous trade agreements aimed at reducing withholding taxes on dividends, interest, and royalties. Moreover, if a company boasts shareholders from other countries, it may enjoy a withholding tax rate of zero on dividends, interest, and royalties. For individuals, depending on the terms of the agreement in place, income earned in the UAE may be exempt from taxation in their home country.

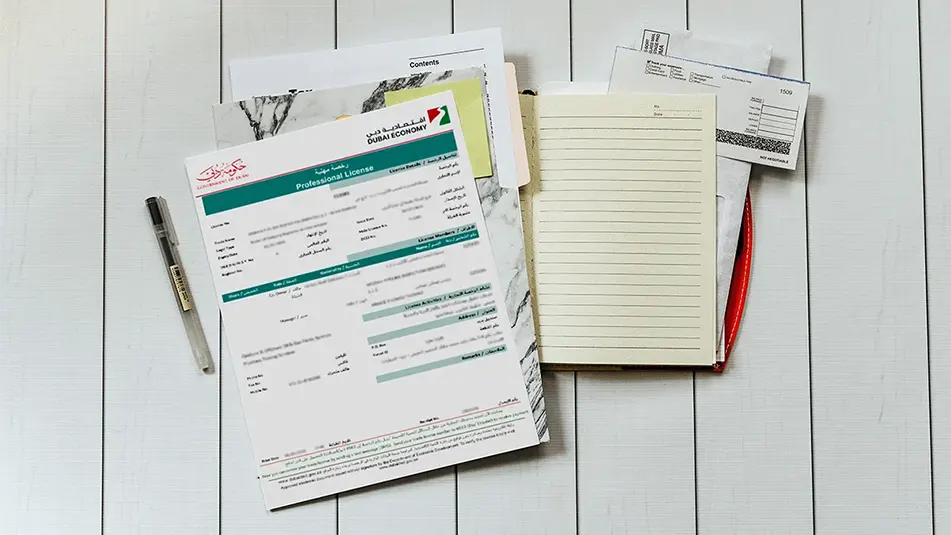

Double Taxation Avoidance Agreements (DTAAs) are pivotal in ensuring that both residents and non-residents of the UAE are not subjected to double taxation on profits generated within the country. To avail of these benefits, companies or individuals must possess a Tax Domicile Certificate (TDC), also known as a Tax Residency Certificate (TRC).

Tax Residency Certificate in the UAE:

The Tax Residency Certificate is accessible to companies that have been fully operational within the UAE for at least one year. However, companies headquartered outside the country, including offshore entities, are ineligible and must instead apply for the Tax Exemption Certificate.

Residents of the UAE who have spent more than 180 days in the country may apply for a tax residency certificate. Applicants must hold a valid UAE resident visa or demonstrate their ability to obtain one. This certificate proves especially advantageous for individuals residing in countries lacking a double taxation agreement with the UAE.

Should you require assistance with double taxation matters as an individual, company, or UAE resident, or if you seek guidance on any other tax-related issues in Abu Dhabi, Dubai, or beyond, please do not hesitate to reach out to us.