Following the completion of company setup and residency visa procedures, the next crucial step is opening a business bank account in the UAE. Without a corporate bank account, a company essentially lacks purpose!

However, opening a corporate bank account in the UAE has garnered a reputation for being bureaucratic, complex, and frustrating – unfortunately, this reputation holds true. It’s no easy feat and demands considerable time and effort due to the internal rules and regulations of each bank.

Here’s a comprehensive guide on navigating the process of opening a corporate bank account in the UAE, covering the essential documents required, challenges to anticipate, and a streamlined solution to overcome these hurdles.

How to Open a Corporate Bank Account in the UAE:

While all banks in the UAE are regulated by the Central Bank of the United Arab Emirates, each maintains its own compliance department and specific policies. Nonetheless, most banks generally follow a similar procedure for initiating the account opening process.

Here are the key steps to opening your business bank account in Dubai or any other UAE emirate:

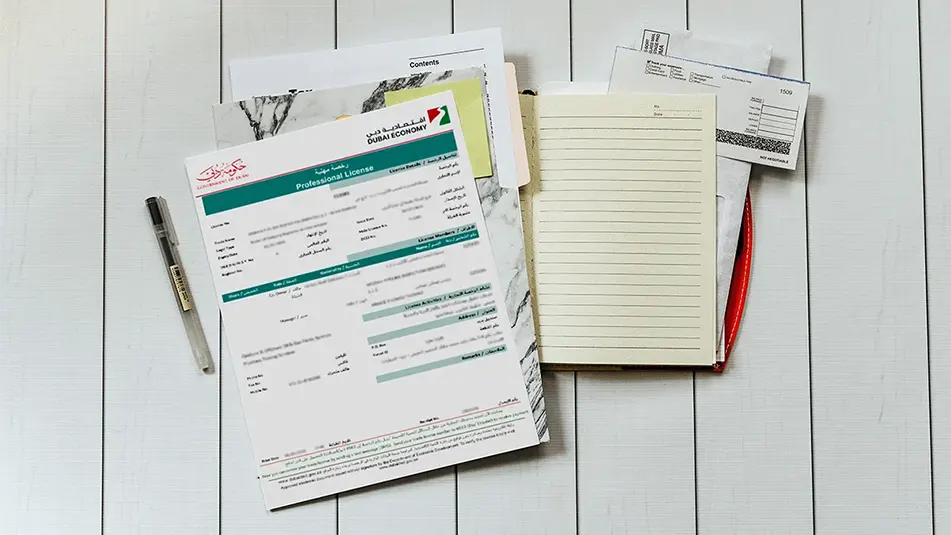

Obtain your trade license:

Your first task in opening a business bank account with any UAE bank is acquiring a UAE trade license. Without a trade license, you won’t be recognized as a legal entity in the UAE. Refer to this practical guide for obtaining your UAE trade license.

Choose your bank:

The UAE boasts numerous banks, both local and branches of foreign institutions. Each bank has developed its own reputation over time – some are known for faster procedures, others for credibility, and some are more discerning with transactions. Therefore, it’s crucial to carefully select your bank based on its reputation, advantages, and disadvantages.

Collect required documents:

Typically, the following documents are needed for opening a corporate bank account in the UAE:

- Trade license

- Memorandum of association

- Office lease agreement

- Copies of valid passports for shareholders and managing directors

- Copies of valid Emirates IDs for shareholders and managing directors

- Copies of residence visas for shareholders and managing directors

- Company share certificate

- Banks may request additional documents and certificates on a case-by-case basis, such as a comprehensive CV, utility bills, previous personal bank statements, business plans, lists of clients, or lists of suppliers/partners.

Start the application:

Once you’ve gathered the necessary documents, you’ll need to arrange a face-to-face meeting with a bank representative to kickstart the application process.

Wait:

After submitting all required paperwork, the most challenging part begins – waiting! While opening a corporate bank account is typically a swift process in many countries, it tends to take longer than usual in the UAE.

Why Choose SetupDeal for Outsourcing Corporate Bank Account Opening:

Navigating the process of opening a bank account in the UAE can be a daunting task. It requires a significant amount of time and effort to initiate the application process, followed by a considerable amount of patience as you await the outcome. This becomes especially challenging when time is of the essence during the initial stages of business setup for entrepreneurs.

This is where SetupDeal comes in to alleviate your burden. With established partnerships in various UAE banks, we expedite your application process swiftly and efficiently.

Our team of experienced business consultants possesses in-depth knowledge of UAE rules and regulations, enabling us to steer clear of potential pitfalls, minimize the risk of rejections, and expedite the entire process.

The way you present your personal and company information holds utmost importance, and it’s essential to get it right from the outset. With SetupDeal, you can trust that your application will be handled with precision and professionalism, ensuring a seamless process from start to finish.

Additional Considerations Before Opening a Bank Account in the UAE:

When preparing to open a bank account in the UAE, there are a few other factors worth considering:

1. Proximity of Bank Branches and ATMs: Opt for a bank with branches and ATM machines conveniently located near your office. This ensures easy access and convenience, particularly in emergencies.

2. Account Limitations: Before finalizing your choice of bank, check for any potential limitations, such as the number of transactions allowed, availability of multicurrency accounts, issuance of debit cards, and signing authorities for multiple shareholders.

3. Minimum Balance Requirements: Be mindful of any minimum balance requirements imposed by your chosen bank. Ensure that maintaining the required balance is feasible for you to avoid incurring fees.

FAQs:

Here are answers to some common questions often raised by our clients:

Can non-resident business owners open a business bank account in the UAE?

Yes, non-resident business owners can open business bank accounts in the UAE. However, they may not be eligible for credit or debit cards associated with their accounts.

How long does it take to open a corporate bank account in the UAE?

The timeline varies depending on the bank’s internal policies and procedures. Typically, the process can range from 2 weeks to 3 months, with offshore companies experiencing longer wait times.

How much does it cost to open a corporate bank account in the UAE?

SETUPDEAL offers a service priced at 3000 AED, providing support and advice to present yourself and your business effectively to the bank. This facilitates a smoother account opening process, ensuring organization and compatibility with the bank’s requirements.

Is opening a bank account guaranteed in the UAE?

No, opening a bank account is not guaranteed. It’s crucial to receive proper support from the beginning, as your business license setup and activities significantly influence your success in obtaining a corporate bank account.

Are there minimum balance requirements for a corporate bank account in the UAE?

Minimum balance requirements vary among UAE banks, ranging from zero balance accounts to monthly average accounts. Some banks offer support programs for newly established businesses with zero balance requirements, albeit with limited facilities.

Does the owner need to be present during the corporate bank account application?

With assistance from a business setup company like SETUPDEAL, the owner only needs to be present for face-to-face meetings and signatures, with the remainder handled remotely.

Does a limited company need a business bank account?

Yes, it is legally required for any type of company to have a corporate bank account in the UAE, as using personal bank accounts for business purposes is prohibited.

Is it possible to open a business bank account with a minimum balance in the UAE?

Yes, most UAE banks offer minimum balance accounts, although they may take longer to open compared to other account types.

Is online bank account opening available?

Many UAE banks offer the option to open a corporate bank account online, although it may take longer than expected. The lack of direct contact can also contribute to frustrations regarding the application process/status.

Are multi-currency bank accounts available in the UAE?

Yes, most banks in the UAE offer multi-currency accounts to accommodate diverse business needs.